Contra Costa’s Earn It! Keep It! Save It! (EKS) Campaign is part of a regional effort that provides free tax assistance to low-income workers and helps them to receive their full tax refunds and credits. EKS is a project of the Family Economic Security Partnership (FESP). FESP is a public, private, and non-profit collaborative dedicated to increasing the income and building the assets of low-income individuals and families living in Contra Costa County.

Do I have to receive CalWORKs or other assistance to take advantage of the free tax preparation?

No. If your income last year was $52,000 or less, you may qualify for free tax preparation. U.S. Citizenship is NOT required.

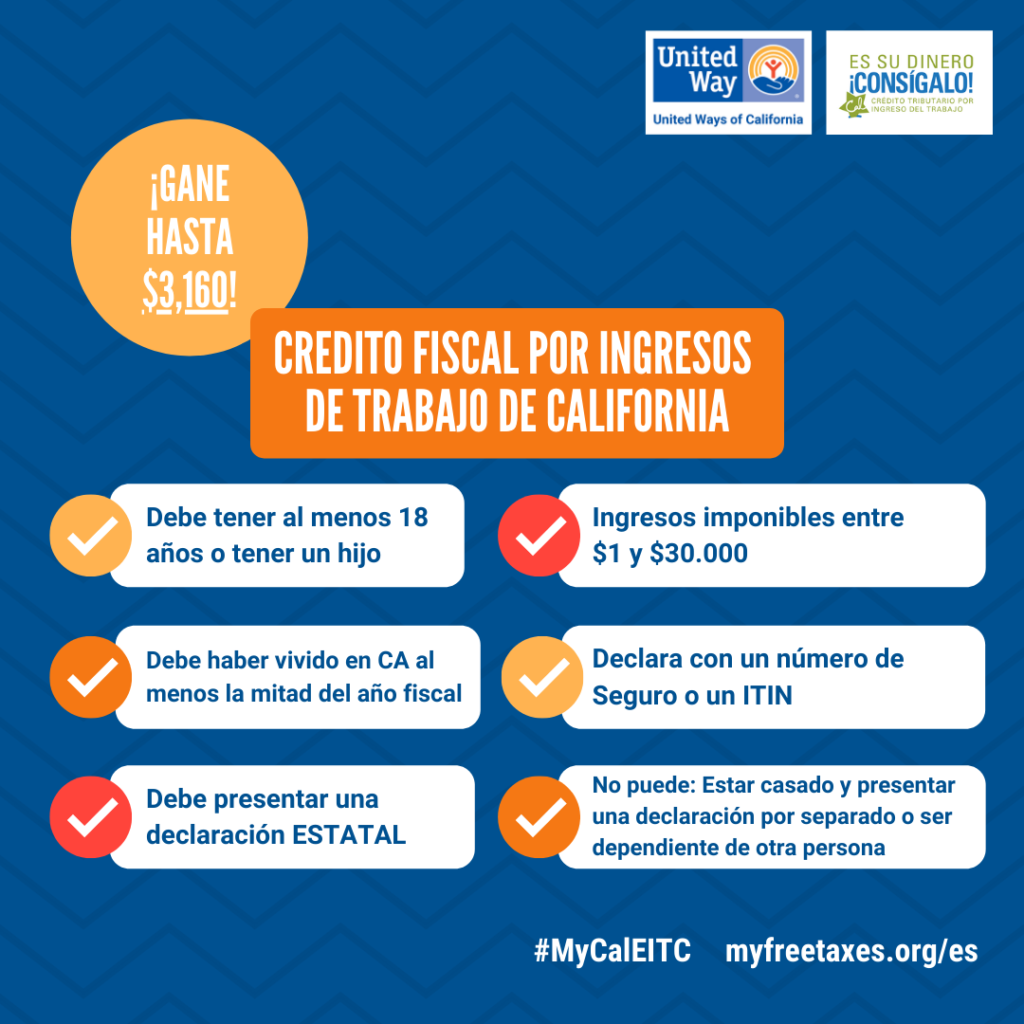

What is the Earned Income Tax Credit and the Child Care Tax Credit?

The Earned Income Tax Credit (EITC) is a refundable federal income tax credit for low-income working individuals and families. When the EITC exceeds the amount of taxes owed, it results in a tax refund to those who claim and qualify for the credit. The Child Tax Credit is a non-refundable credit and may be as much as $1,000 per qualifying child depending upon your income. The Additional Child Tax Credit is a refundable credit and may give you a refund even if you do not owe any tax.

How can I get these tax credits?

All you have to do is apply when filing your tax return. To find out where you can get your taxes done, go to uwba.org/taxhelp.

Where can I apply?

For more information on the EKS program and Volunteer Income Tax Assistance (VITA) locations in Contra Costa County, visit the Earn It! Keep It! Save It! website at http://earnitkeepitsaveit.org.

If you have more questions or have trouble getting a VITA appointment, call toll free

1 (800) 358-8832 or 2-1-1.